How Life Stages Affect Women’s Focus

For women with ADHD, the hormonal changes that come with various life stages can significantly impact how symptoms present and how manageable they feel. From the menstrual cycle to pregnancy and postpartum, hormone fluctuations can lead to challenges in focus, mood regulation, and emotional balance. Understanding how these shifts affect ADHD can help women develop strategies to navigate these changes more effectively. The Menstrual Cycle and ADHD The menstrual cycle plays a key role in influencing ADHD symptoms. During the first two weeks of the cycle, rising estrogen levels are associated with improved mood, cognitive function, and focus. Many women with ADHD feel more in control and find it easier to manage their symptoms during this phase. However, the story changes after ovulation, when estrogen levels drop, and progesterone levels rise. This hormonal shift leads to a decline in dopamine, a neurotransmitter that plays a crucial role in attention and executive function. As a result, many women experience a worsening of ADHD symptoms in the premenstrual phase, including increased difficulty with focus, emotional regulation, and impulsivity. These changes can feel frustrating, as the ebb and flow of hormones can make it seem like symptoms vary drastically throughout the month. Puberty and ADHD Puberty brings another significant wave of hormonal change, particularly with the surge of estrogen and progesterone. For girls with ADHD, these changes can intensify symptoms. Emotional volatility, mood swings, and increased difficulty with attention and impulse control are common during this time. Puberty also coincides with social and academic pressures, which can make managing ADHD symptoms even more challenging. Parents and educators play a critical role during this period by offering understanding, support, and potentially adjusting treatment strategies. It’s important to recognize that ADHD management may need to evolve as a girl transitions through puberty, as the combination of hormonal changes and environmental demands can complicate symptom control. Pregnancy and ADHD Challenges Pregnancy presents unique challenges for women with ADHD. The dramatic hormonal changes that occur during pregnancy can affect mood and cognitive function, often leading to worsened ADHD symptoms. Many women also face the dilemma of whether to continue ADHD medications during pregnancy due to concerns about their safety. Balancing the benefits and risks of continuing medication can be difficult, and decisions should be made in close consultation with healthcare providers. For those who choose to pause medication, non-pharmacological strategies like cognitive-behavioral therapy (CBT) and lifestyle adjustments can be particularly helpful. It’s important to stay flexible and explore alternative treatments to manage symptoms during this time. The Postpartum Period and ADHD The postpartum period is an especially challenging time for women with ADHD. Hormonal fluctuations, combined with sleep deprivation and the demands of caring for a newborn, can significantly exacerbate symptoms. Focus, organization, and emotional regulation may become even more difficult, making the early months of motherhood overwhelming. Support from healthcare providers, family, and friends is crucial during this period. Establishing routines, seeking help with childcare, and leaning on a support network can all help mitigate some of the stress that comes with being a new mother while managing ADHD. Open communication with healthcare professionals about any changes in symptoms can also ensure that appropriate treatment plans are in place. Managing ADHD Across Life Stages No matter the life stage, managing ADHD effectively often requires a combination of medical treatment and lifestyle adjustments. Regular exercise, maintaining a balanced diet, and good sleep hygiene are essential components of overall brain health and can help reduce the impact of hormonal fluctuations. Cognitive-behavioral therapy (CBT) can be particularly helpful for women dealing with stress and emotional regulation challenges that arise from hormonal changes. This type of therapy provides strategies for managing negative thought patterns and improving organizational skills, making it easier to cope with the complexities of ADHD. Tracking symptom patterns in a diary can help women and their healthcare providers identify how hormonal shifts affect ADHD symptoms. Adjusting medication and treatment plans based on these patterns allows for more tailored management strategies, ensuring that symptoms remain under control even during hormonal transitions. The Role of Estrogen in ADHD Estrogen plays a significant role in regulating neurotransmitters like dopamine, serotonin, and norepinephrine, all of which are involved in attention, mood, and cognitive function. Higher levels of estrogen are often associated with improved attention and executive functioning, while lower levels can exacerbate ADHD symptoms. This understanding helps explain why many women experience relief from symptoms during certain phases of their menstrual cycle or during life stages when estrogen levels are higher. Conversely, periods of low estrogen, such as during the premenstrual phase or postpartum—can lead to more pronounced symptoms. Building a Strong Support System In addition to medical treatments and lifestyle changes, building a strong support system is crucial for women with ADHD. Support groups, whether in-person or online, can provide valuable insight and a sense of community. Women can share experiences, exchange strategies, and learn from others who are navigating similar challenges. Healthcare providers, including ADHD specialists and therapists, offer another essential layer of support. Regular consultations with these professionals ensure that treatment plans remain effective and can be adjusted as needed. Educational resources, such as books and reputable websites, also provide useful information on managing ADHD at different life stages. The impact of hormonal changes on ADHD symptoms is undeniable, but with the right strategies and support, women can navigate these fluctuations more effectively. By understanding how hormones influence ADHD symptoms, adjusting treatment plans, and building a strong support network, women can take control of their health and better manage ADHD across the different stages of life.

Untangling Menopause and ADHD

Menopause is a significant life transition that brings about a range of physical and emotional changes, and for women with ADHD, it can present unique challenges. As estrogen and progesterone levels decline, many women find that their ADHD symptoms intensify. Here’s a look at how menopause impacts ADHD, why diagnosing and treating the condition can be particularly challenging during this time, and effective strategies to manage symptoms. The Impact of Menopause on ADHD Symptoms Menopause triggers a substantial shift in hormone levels, notably a decrease in estrogen and progesterone. These hormones play an important role in regulating neurotransmitters like dopamine and serotonin, which are essential for managing attention, focus, and mood. As hormonal levels fluctuate and eventually decline, many women with ADHD may notice a worsening of symptoms such as difficulties with concentration, memory lapses, and challenges with emotional regulation. Additionally, the stress and sleep disturbances commonly associated with menopause can further exacerbate these symptoms. The Challenge of Diagnosing ADHD During Menopause Diagnosing ADHD during menopause can be complex due to the overlap in symptoms. Both menopause and ADHD can present with difficulty concentrating, irritability, and mood swings, making it challenging to differentiate between the two. For women who have never been previously diagnosed with ADHD, it can be particularly confusing to recognize these symptoms as related to ADHD rather than attributing them solely to menopause. The lack of awareness about ADHD in adult women adds another layer of difficulty to the diagnostic process. The Complexities of Treatment Treating ADHD during menopause involves navigating the interplay between hormonal changes and ADHD medication. Hormonal fluctuations can impact how women respond to ADHD treatments, with the effectiveness of stimulant medications potentially varying throughout different stages of menopause. Additionally, managing ADHD alongside menopausal symptoms often requires a multifaceted approach. This may include hormone replacement therapy (HRT), lifestyle adjustments, and careful monitoring of medication efficacy and side effects. Coordinating these treatments requires a nuanced approach to avoid adverse effects and ensure comprehensive care. How Common is the Worsening of ADHD Symptoms During Menopause? Research indicates that it is relatively common for women with ADHD to experience a worsening of symptoms during menopause. A survey found that 94% of women with ADHD reported increased difficulties during perimenopause and menopause. This suggests that hormonal fluctuations significantly impact ADHD symptoms, though the exact prevalence can vary. More research is needed to fully understand the extent of these effects. Strategies for Managing ADHD Symptoms During Menopause Effective management of ADHD symptoms during menopause involves a blend of medical and lifestyle strategies. Hormone replacement therapy (HRT) can help stabilize hormone levels, potentially alleviating some symptoms that overlap with ADHD, such as mood swings and cognitive difficulties. Additionally, maintaining a healthy lifestyle with regular exercise, a balanced diet, and good sleep hygiene supports overall brain health. Cognitive-behavioral therapy (CBT) and mindfulness practices are also valuable tools for managing both ADHD and menopausal symptoms. Regular consultations with healthcare providers are essential to adjust treatment plans as needed. Common Misconceptions About ADHD and Menopause Several misconceptions can hinder the understanding and treatment of ADHD in menopausal women. One common myth is that ADHD only affects children and is not relevant for adults, especially women. Another misconception is that menopausal symptoms are solely due to hormonal changes and not related to ADHD. These misunderstandings can lead to underdiagnosis and undertreatment. Additionally, the belief that ADHD symptoms improve with age is not always accurate, as symptoms may persist or even worsen. Advocating for Effective Treatment Women can advocate for their health by keeping detailed records of their symptoms and any changes they observe. Seeking out healthcare providers who are knowledgeable about both ADHD and menopause is crucial. Joining support groups and staying informed about the latest research can empower women to make informed decisions about their treatment. Being proactive in discussions with healthcare providers about all symptoms and treatment options is key to receiving effective care. Lifestyle Changes to Support ADHD Management Several lifestyle changes can be beneficial in managing ADHD symptoms during menopause. Regular exercise, a diet rich in omega-3 fatty acids, good sleep hygiene, and stress-reduction techniques such as yoga or meditation can all contribute to improved brain health. Staying organized with tools like planners and reminders can also help manage daily tasks more effectively. The Role of Hormone Replacement Therapy and Cognitive-Behavioral Therapy Hormone replacement therapy (HRT) can help stabilize hormone levels and reduce some of the menopausal symptoms that overlap with ADHD, such as mood swings and cognitive difficulties. However, it’s important to weigh the potential risks and benefits of HRT with a healthcare provider. Cognitive-behavioral therapy (CBT) is also a valuable tool for managing both ADHD and menopausal symptoms. CBT can help develop coping strategies, improve organizational skills, and address negative thought patterns, aiding in emotional regulation and daily functioning. Managing ADHD during menopause requires a comprehensive approach that addresses both hormonal changes and ADHD symptoms. By understanding the impact of menopause on ADHD and utilizing effective strategies, women can navigate this challenging period with greater ease and improve their overall quality of life.

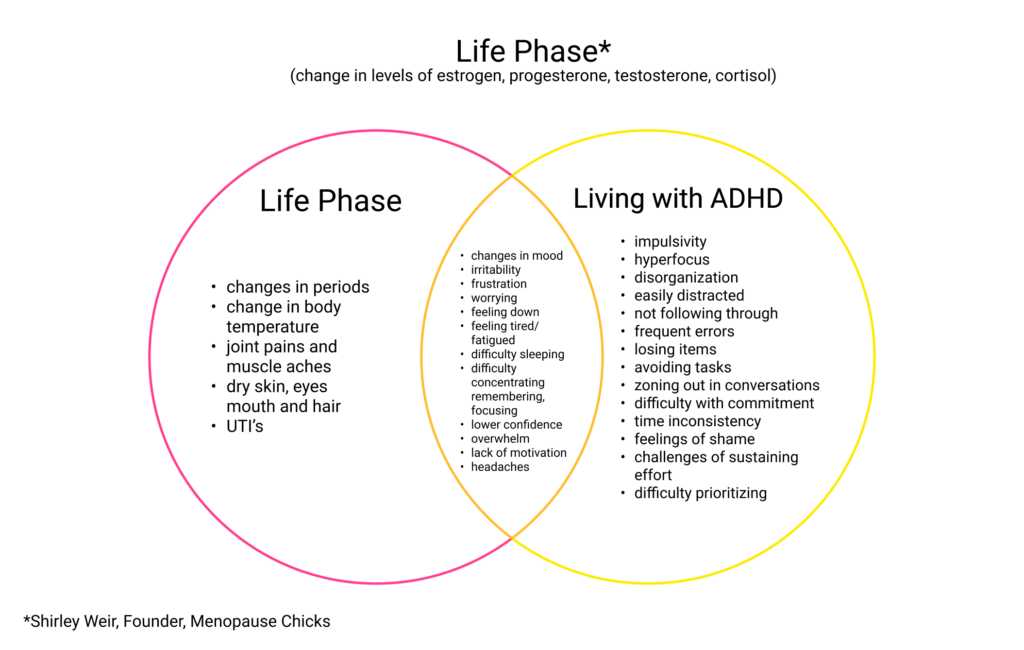

Navigating the Intersection: ADHD and Menopause

Both ADHD and menopause can profoundly affect women’s lives, often in overlapping ways that can make it difficult to distinguish between the two. While ADHD is a neurodevelopmental condition with symptoms like inattention, impulsivity, and executive dysfunction, menopause brings hormonal shifts that impact mood, memory, and cognitive function. These changes can exacerbate ADHD symptoms or even mimic them, leading to a unique set of challenges for women experiencing both. This diagram highlights the distinct symptoms of ADHD and menopause, while also illustrating the significant areas of overlap, offering insight into the shared struggles many women face.

ADHD Experiences Across the Lifespan: A Gender Perspective

ADHD Experiences Across the Lifespan: A Gender Perspective This chart compares male and female experiences with ADHD throughout life, acknowledging the unique journeys they often face. While there are recognized patterns and themes in how ADHD manifests across genders, it’s important to remember that each person’s experience is unique. These findings are not absolute, and individual experiences may differ significantly. It’s important to note that the studies reflected here are based on binary data and do not fully represent the experiences of non-binary or transgender individuals. Research in these areas is still limited, and more comprehensive studies are needed to better understand ADHD in diverse populations.

ADHD and Shopping in Canada

ADHD and Shopping in Canada Adults with ADHD across Canada face unique shopping challenges that can significantly impact their financial well-being. From the bustling shopping centers of Toronto, Ontario to the retail districts of Vancouver, British Columbia, ADHD shopping struggles stem from core symptoms including impulsivity, distractibility, and executive function difficulties. Understanding these ADHD shopping behaviors is essential for Canadians seeking better financial control. How ADHD Affects Shopping Behavior Across Canada Impulsive Spending and ADHD in Canadian Retail Environments ADHD impulsive buying occurs when the brain seeks immediate dopamine rewards through spontaneous purchases. Whether shopping at West Edmonton Mall in Alberta, CF Toronto Eaton Centre in Ontario, or local retailers in Charlottetown, Prince Edward Island, this neurological drive often leads to: Unplanned spending sprees at major Canadian retailers Buyer’s remorse and financial stress affecting household budgets Difficulty distinguishing between needs and wants in Canada’s consumer market Regional Shopping Challenges for ADHD Adults ADHD distractibility while shopping manifests differently across Canadian provinces: Urban centers (Vancouver BC, Calgary AB, Toronto ON, Montreal QC): Overwhelming sensory stimuli from busy shopping districts Northern territories (Yukon, Northwest Territories, Nunavut): Limited shopping options leading to bulk buying or online shopping dependency Maritime provinces (New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador): Seasonal shopping patterns affecting impulse control Prairie provinces (Saskatchewan, Manitoba): Large format stores requiring better navigation strategies Provincial ADHD Shopping Resources and Strategies Pre-Shopping Planning for Canadian ADHD Adults Successful ADHD shopping management varies by location: British Columbia: Utilize BC’s extensive transit apps to plan shopping routes and avoid peak hours at Metrotown or Pacific Centre. Alberta: Take advantage of no provincial sales tax for better budget planning at CrossIron Mills or Kingsway Mall. Saskatchewan & Manitoba: Plan for seasonal shopping patterns and use local flyer apps to avoid impulse purchases during harsh winter months. Ontario: Navigate complex tax structures (HST) and use GTA transit apps for off-peak shopping at major centers like Square One or Yorkdale. Quebec: Consider language preferences when using French shopping apps and budgeting tools available in Montreal and Quebec City. Maritime Provinces: Plan for limited store hours and seasonal availability, especially in rural areas of New Brunswick, Nova Scotia, and Prince Edward Island. Newfoundland and Labrador: Account for higher shipping costs and limited retail options when budgeting. Northern Territories: Develop strategies for bulk purchasing and online shopping due to limited local retail options in Yukon, Northwest Territories, and Nunavut. Managing ADHD Impulse Control in Canadian Stores Cash-only shopping method: Use Canadian currency exclusively to prevent credit card overspending at major retailers like Loblaws, Canadian Tire, or Hudson’s Bay. Provincial tax awareness: Factor in GST/HST rates (5-15% depending on province) when setting cash budgets. 24-hour waiting rule: Especially important for online purchases due to Canada’s consumer protection laws and return policies. Online Shopping with ADHD Across Canada ADHD online shopping risks require Canada-specific strategies: Use Canadian price comparison sites (ShopBot.ca, Shopping.com) Set browsing limits for major Canadian retailers (Amazon.ca, Walmart.ca, Costco.ca) Understand provincial consumer protection laws for returns Factor in shipping costs to remote areas in northern territories Provincial ADHD Support Resources Professional Support by Province/Territory British Columbia: ADHD support groups in Vancouver, Victoria, and Burnaby Alberta: Calgary and Edmonton ADHD clinics and coaching services Saskatchewan: Saskatoon and Regina mental health resources Manitoba: Winnipeg ADHD support networks Ontario: Extensive ADHD services in Toronto, Ottawa, Hamilton, and London Quebec: French and English ADHD support in Montreal and Quebec City Atlantic Canada: Regional ADHD resources across all four maritime provinces Northern Territories: Telehealth ADHD support options for remote communities Managing ADHD Shopping Anxiety Coast to Coast Practice mindfulness techniques suitable for Canadian climate changes Recognize seasonal affective patterns that may increase impulse shopping Seek culturally appropriate support in diverse Canadian communities Conclusion: ADHD Shopping Success Across Canada While ADHD shopping difficulties present unique challenges across Canada’s diverse retail landscape, implementing region-specific strategies significantly improves spending control. From the urban shopping centers of major Canadian cities to the limited retail options in northern communities, adults with ADHD can develop effective coping mechanisms. Provincial considerations for ADHD shopping success: Understand local tax structures, utilize regional transit systems for off-peak shopping, leverage provincial consumer protection laws, and access location-appropriate professional support when needed.

‘The Trauma of Money’ by Chantel Chapman

The ADHD Centre for Women is excited to announce the book launch of Advisory Board Member Chantel Chapman’s new release, “The Trauma of Money: Mapping Compassionate Pathways to Healing Financial Trauma and Disempowering Financial Shame.” This much-anticipated book will be available in stores and online beginning September 23, 2025. Discover how financial wellness and mental health intersect, and explore resources that support women with ADHD in overcoming financial shame. About the Author: Chantel Chapman Chantel Chapman is an influential voice in financial education and trauma-informed practices. As an Advisory Board Member and CEO, her work empowers women to better understand the emotional and psychological sides of money management, aligning with the ADHD Centre for Women’s mission to support holistic well-being. Book Overview: The Trauma of Money “The Trauma of Money” presents compassionate strategies for healing financial trauma and breaking cycles of financial shame. The book is especially relevant for women with ADHD, who may face distinct challenges around money and self-worth. By mapping compassionate pathways, Chantel provides actionable insights to help readers foster healthier relationships with their finances and themselves. Why This Book Matters for Women with ADHD Financial stress is a common struggle among adults with ADHD. This book offers targeted pathways to address financial trauma, build resilience, and create empowering habits. If you or someone you know is managing ADHD and wants a fresh perspective on financial healing, this launch shines a light on essential resources. How to Purchase and Learn More Grab your copy in stores or online starting September 23, 2025. For more details about the book and the author, visit: Optimize your financial health journey and support the ADHD Centre for Women’s commitment to empowering women today!

Neurodiversity Newsletter Issue #2 November 2025

The November 2025 issue of Neurodiversity News is packed with impactful stories, resources, and events for the ADHD and autism communities, offering essential support and expert-led learning opportunities for neurodivergent adults and allies. A Focus on Empowerment and Community This second edition opens with an editorial from Andrea Dasilva, who highlights a central theme: celebrating neurodiversity and fostering inclusion. Readers are reminded of the importance of self-acceptance and community, as well as innovative adaptations and strengths that neurodivergent individuals bring to every aspect of life. Key Features and Insights Webinars and Learning Events November’s calendar is filled with events designed for education and connection: Spotlight on Team and Contributors This issue recognizes both its editorial staff and contributing writers, including Andrea Dasilva and Mark Sperber, who share professional and lived experiences to inspire readers. The editorial team includes Patrick Wachter, Dr. Anita Parhar, Dr. Gurdeep Parhar, Devon Krahenbil, and Chandler Cumming. Advocating for Neurodiversity Year-Round Neurodiversity News continues to build a space for advocacy, education, and partnership in British Columbia and beyond, inviting stories from readers and offering ways to get involved. Whether seeking assessment, training, or support, this newsletter shows how collaboration and expert guidance can turn understanding into meaningful support for all. This November edition is a testament to the growing strength and voice of neurodiverse communities, providing valuable insights for individuals, families, healthcare professionals, and allies.

Neurodiversity News | December 2025

December 2025 Neurodiversity Newsletter Issue #3 The December 2025 Neurodiversity Newsletter (Issue No. 3) is presented as a warm, informative roundup that celebrates, supports, and empowers neurodivergent adults and their communities. It brings together lived-experience stories, practical strategies, assessment guidance, and professional learning opportunities focused on ADHD, autism, and neuro-affirming care. Please click this button to find the PDF of the latest issue READ THE LATEST ISSUE Welcome and overall focus In this issue, readers are invited to reflect on how sleep, movement, sensory regulation, and community shape everyday life for neurodivergent adults. The publication highlights offerings from the Adult ADHD Centre, Adult Autism Centre, ADHD Training Academy, and the Bold Education Skills Treatment (BEST) Program, emphasizing collaboration across these services. “Tired But Wired” – ADHD and sleep The first featured story, “Tired But Wired” by Marlee Boyle (BSc, RRT, CCSH), examines the complex relationship between ADHD and sleep. It explains how sleep deprivation can intensify difficulties with attention, working memory, and emotional regulation in people with ADHD, creating a cycle of exhaustion and worsening symptoms. The article introduces two key processes: sleep pressure (Process S), which builds the longer someone is awake, and the circadian rhythm (Process C), the 24‑hour internal clock. Many adults with ADHD experience delayed circadian rhythms and feel most alert late at night, which often leads to racing thoughts at bedtime and mornings that begin already fatigued. Everyday factors such as stimulant medications, caffeine, daytime napping, and sleeping in are described as influences that can disrupt sleep pressure and delay sleep onset, but the story also notes that targeted treatment and education can help break this cycle. “Singing and Dancing” – regulation through movement The second featured story, “Singing and Dancing” by Andrea Dasilva (MEd, RCC), offers a hopeful perspective on emotional regulation during a busy time of year. It explores how singing and dancing can bridge the gap between seasonal overwhelm and moments of calm. Andrea describes how music and movement support emotional regulation, attention, concentration, and social bonding, with or without spoken language. Whether neurodivergent or neurotypical, readers are encouraged to see singing and dancing as accessible tools that help release stored emotions, ease tension, and clear mental “fog,” not just as holiday traditions but as year-round supports for busy brains. Navigating sensory overload during the holidays Another major feature, “Navigating Sensory Overload During the Holidays: Practical Tips,” focuses on the reality that festive environments can quickly become overwhelming for autistic, ADHD, highly sensitive, or anxious adults. It acknowledges the impact of bright lights, loud gatherings, strong scents, unpredictable schedules, and increased social expectations. The piece offers practical strategies such as: Checking in with internal needs like hunger, thirst, and fatigue to reduce vulnerability to sensory overload. Setting expectations before events, including where someone is going, who will be there, and how long they realistically intend to stay. Communicating sensory needs in advance to hosts or organizers, such as requesting lower music volume, quieter seating, or the freedom to step away. Further suggestions include protecting “anchor routines” like sleep, meals, and downtime, bringing a personalized sensory toolkit (for example, headphones, sunglasses, fidgets, or portable deep‑pressure items), and treating breaks as a deliberate regulation strategy. The article closes with guidance for sensory‑friendly hosting, such as softer lighting, moderate sound levels, quiet spaces, and seating options away from crowds, to help neurodivergent guests participate more comfortably. Adult Autism Centre – what to expect from an autism assessment The Adult Autism Centre section provides a step‑by‑step overview for adults considering an autism assessment. It breaks the process into four key steps: defining goals, gathering information, attending an interview, and receiving a written assessment report. Readers learn that the first stage involves clarifying what they hope to gain from an assessment, such as self-understanding, accommodations, or direction for future supports. The next step includes completing an Autism Assessment Tool that covers childhood history, health background, family context, and lived social experiences, sometimes with help from a partner, friend, or family member. The clinical interview then explores current functioning and past experiences in a collaborative, non‑judgmental environment, and the final report summarizes the discussion, offers a diagnosis when appropriate, and outlines recommendations and accommodations. The section notes that a high proportion of individuals with ADHD also meet criteria for Autism Spectrum Disorder and explains how overlapping traits, such as challenges with social cues and sensory sensitivities, can complicate self-understanding. The Adult Autism Centre emphasizes timely, more affordable assessments for adults in Canada, including a Parhar Compassion Program for those who qualify, and underlines that a diagnosis can support self‑acceptance, advocacy, and access to supports and accommodations. BEST Program – community for adults with ADHD The Bold Education Skills Treatment (BEST) Program is introduced as a way for adults with ADHD to begin 2026 feeling more connected and supported. It addresses the reality that many neurodivergent adults feel isolated or misunderstood and positions BEST as a welcoming, judgment‑free community. BEST is delivered entirely online and offers two monthly webinars on topics such as sleep, medication, impulse control, organization, and focus. Sessions are led by Dr. Gurdeep Parhar along with guest experts who address related areas like financial well‑being, nutrition, and everyday organization. In addition to structured learning, the program gives members opportunities to connect with each other, share experiences, and offer mutual support. Many participants report that meeting others who truly understand ADHD makes the condition feel less isolating and more manageable. ADHD Training Academy and ADHD‑CEPP certification For professionals, the newsletter highlights the ADHD Training Academy and its ADHD‑Certified Expert Practicing Professional (ADHD‑CEPP™) program. This section explains that ADHD affects approximately 1 in 20 adults in Canada and that stigma and misinformation can create barriers in workplaces, educational settings, and healthcare. The ADHD‑CEPP program is designed for a wide range of professionals—including educators, healthcare providers, social workers, human resources teams, and those in communications or marketing—who support neurodivergent adults. It consists of 12 online modules covering key aspects of ADHD, such as medication, sleep, and co‑existing conditions,

Neurodiversity News | January 2026

January 2026 Neurodiversity Newsletter Issue #4 The January 2026 Neurodiversity Newsletter (Issue No. 4) is a warm, practical roundup designed to support neurodivergent adults and the people who walk alongside them—spotlighting sleep, seasonal wellbeing, autism assessment, community, and professional learning. It weaves together lived experience, science-informed strategies, and concrete next steps from the Adult ADHD Centre, Adult Autism Centre, ADHD Training Academy, and the BEST Program. Please click this button to find the PDF of the latest issue Read the latest issue Sleep, music, and seasonal wellbeing January’s featured pieces explore how brains and bodies try to cope with dark, busy winter months—and what can actually help. Readers move from understanding “tired but wired” ADHD sleep patterns, to the regulating power of music, to gentle strategies for Seasonal Affective Disorder (SAD). Sleep and ADHD – “Tired But Wired”: Marlee Boyle (Sleep Works) explains why ADHD and insomnia so often travel together, how disrupted sleep pressure and circadian rhythms fuel brain fog, and how ADHD-adapted CBT‑I can rebuild confidence in sleep. Neurodiversity Playlist: Andrea Dasilva shares how music lights up brain networks, supports emotional regulation and focus, lowers cortisol, and offers validating “someone else gets it” moments—inviting readers to co-create a community playlist. Managing Seasonal Affective Disorder: A dedicated article unpacks why winter can hit neurodivergent adults harder, and offers small, realistic supports like light therapy, simple routines, movement, balanced meals, and connection. Assessments, community, and skills-building Alongside psychoeducation, the issue highlights concrete pathways to clarity, community, and day‑to‑day skills. The focus is on making assessment and support more accessible, less isolating, and more empowering. Adult Autism Centre: A step‑by‑step overview walks adults through defining goals, gathering history, completing the clinical interview, and receiving a written report, with transparent pricing and the Parhar Compassion Program for reduced‑cost assessments. BEST Program (Bold Education Skills Treatment): Adults with ADHD are invited into an online, judgment‑free membership community featuring two monthly webinars on topics like sleep, impulse control, organization, and focus, led by Dr. Gurdeep Parhar and guest experts. CADDAC Coaching Programs: Partner listings include adult and youth ADHD group coaching, offering practical tools, accountability, and peer support over multiple weeks. Professional learning and January webinars For clinicians, educators, and other professionals, the newsletter showcases structured education and a full calendar of live learning opportunities. ADHD Training Academy & ADHD‑CEPP™: The 12‑module ADHD‑CEPP program supports professionals across sectors to deepen ADHD expertise, with each module followed by an exam and a limited‑time tuition promotion for early 2026 enrollees. January 2026 events: Webinars span ADHD & Friendships (BEST‑member exclusive), Disability Tax Credit sessions for both physical and mental health conditions, “Diagnosed with ADHD, Am I Also Autistic?”, “Autism Assessments for Adults: Why and How?”, and ADHD & Workplace Accommodations. Partners, team, and staying connected The closing pages spotlight partners such as CADDAC and thank the multidisciplinary team behind Neurodiversity News, including Editor‑in‑Chief Devon Krahenbil, Assistant Editor Chandler Cumming, contributors like Marlee Boyle and Andrea Dasilva, and co‑founders Drs. Gurdeep and Anita Parhar. Readers are invited to share their own stories, subscribe to future issues, and stay in touch with the Adult ADHD Centre and its partner organizations throughout 2026. Subscribe To Our Newsletter